I have actually been interested in finances and investments this summer. I guess that my top reasons are:

- constantly being tired of losing money

- working at dead-end and minimum-wage jobs for a long period of time

If you (American or Western man) are in the same boat with me, please read my rationale of becoming a long-term investor. Also, click on another recent blog post if you crave expert financial advice from a renowned and rich investor (Warren Buffett). Follow this simple 8-step process so that you can reach your fiscal goals and escape from debts (i.e. student loan, credit card, medical, etc.), shortage of money, and other economic problems forever:

Streaming a certain video from “Sara Finance” YouTube channel has caused me to become curious about affiliate marketing. In fact, I have written and reviewed various products, websites, etc. on previous blog posts. But I would be astonished if I receive credit or reward(s) for them someday. Whether that possibility occurs or not, I want to do some sort of affiliate marketing currently by explaining below 10 specific assets that might encourage you to invest daily, weekly, biweekly, or monthly. You can do the same task on any online broker such as Robinhood, Vanguard, Webull, Charles Schwab, or something else similar to any of them. But, please initially check the ratings and reviews of each brokerage website on “Google Play Store” website or app so that you can pick the one(s) that suits your financial needs/desires.

So, without further ado, here is my list for these investments that can turn you into a millionaire during your retirement:

stock – Nvidia (NVDA) – $129+ per full share

If you are concerned about certain stocks (which are small, fractional, or entire shares of ownership of a company or companies) to gain, multiple investors on YouTube are going to perhaps recommend you to buy a piece of this one – Nvidia (NVDA). The individual business stock focuses principally on computer graphics compressors, chipsets, and multimedia software. Why should you constantly purchase numerous shares on NVDA? Author Jeremy Bowman of “The Motley Fool” website provides his purposes:

- popularity and fiscal growth of AI infrastructure

- the commitment and faith that Google, Microsoft, Tesla, OpenAI, etc. companies have within the solo stock

- the possibility that NVDA can outperform the work of humanity through artificial general intelligence (AGI)

- the auxiliary power that the stock is given to overcome stock market volatility

If you are still unsure or interested in obtaining more details about NVDA, please visit a couple of these YouTube channels as well as write and gather complicated terms that the investors speak:

- “Smart Money Bro”

- “Everything Money”

- “Minority Mindset” plus “Minority Mindset Clips”

- “The Dream Green Show”

Engage and become a perennial shareholder of a firm (NVDA) that can take you beyond your wildest dreams.

bond – U.S. 10-Year Treasury Note (TMUBMUSD10Y) – $100+ per full share

A bond may be necessary for your asset portfolio (aka investment portfolio) because it not only can protect your stocks or assets but also it can help you skip the payment of increased debts and/or other fees. The one that is capable of turning your fiscal dreams into a reality is the 10-Year Treasury Note (aka T-notes) which lasts up to a decade. Maintaining partial ownership of it leads to positive effects such as:

- unlimited safety and support form the U.S. government

- full maturity lasting between 1 and 10 years

- no obligation to pay state and local taxes

- chance to sell T-notes before the end of the 10-year period

You are able to purchase T-notes at your bank, TreasuryDirect.com, or a brokerage website (i.e. Robinhood, Vanguard, or Webull). Be totally aware that they are electronic assets only. Fortunately, you can print them as paper certificates for clear evidence.

“Treasury sells $42 billion in 10-year notes” video – “CNBC Television” YouTube channel

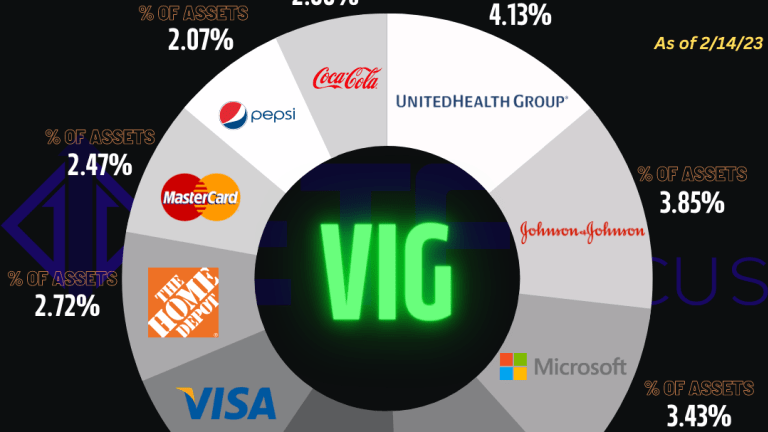

dividend exchange-traded fund (dividend ETF) – Vanguard Dividend Appreciation ETF (VIG) – $190+ per full share

Unlike an individual company stock, an exchange-traded fund (ETF) can ease your mind due to its capacity to contain or cover the amount of assorted or mixed stocks. You may cherish the Vanguard Dividend Appreciation ETF (VIG) because you are given monetary access and capital of 339 large-cap stocks that may surprise and overwhelm you as a first-time investor. But, as time elapses, you may become very proud and confident of your decision. For every 3 months, VIG should pay you $3.35 for each share that you own based on its dividend yield (1.75%). If you keep buying additional equities of VIG for the long run, you can become wealthy especially from possibly reinvesting your dividends. This ETF exposes you to the following global businesses:

- Visa Inc. (V)

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- J.P. Morgan Chase & Co. (JPM)

- MasterCard Inc. (MA)

- Proctor & Gamble Co. (PG)

- Johnson & Johnson (JNJ)

What a great feeling it is to be affiliated with famous businesses and their big bucks.

fundamental ETF – Schwab U.S. Dividend Equity ETF (SCHD) – $82+ per full share

If you are more bothered about losing money or buying investments that might increase your passive or portfolio income, then you may eventually quit or regretfully trade stocks. Howbeit, if you choose to remain optimistic, patient, and stubborn in buying more shares of the same asset(s), then the fundamental ETF such as the Schwab U.S. Dividend Equity ETF (SCHD) is for you. You need to research, investigate, and comprehend it regarding its:

- SEC filings (regarding Form 10-K and Form 10-Q)

- financial statements

- revenue and earnings growth

- dividends

- macroeconomic trends

- technicals

- so on

Please visit these 2 article links for supplementary details of the fundamental ETF:

- trendspider.com/learning-center/understanding-the-basics-of-fundamental-investing/

- schwabassetmanagement.com/products/schd

At a total expense ratio (TER) of 0.06%, you should owe low taxes and fees as well as receive fair returns as dividends just by owning piece(s) of the ETF.

“What SCHD ETF Changes Means For You” video – “Everything Money” YouTube channel

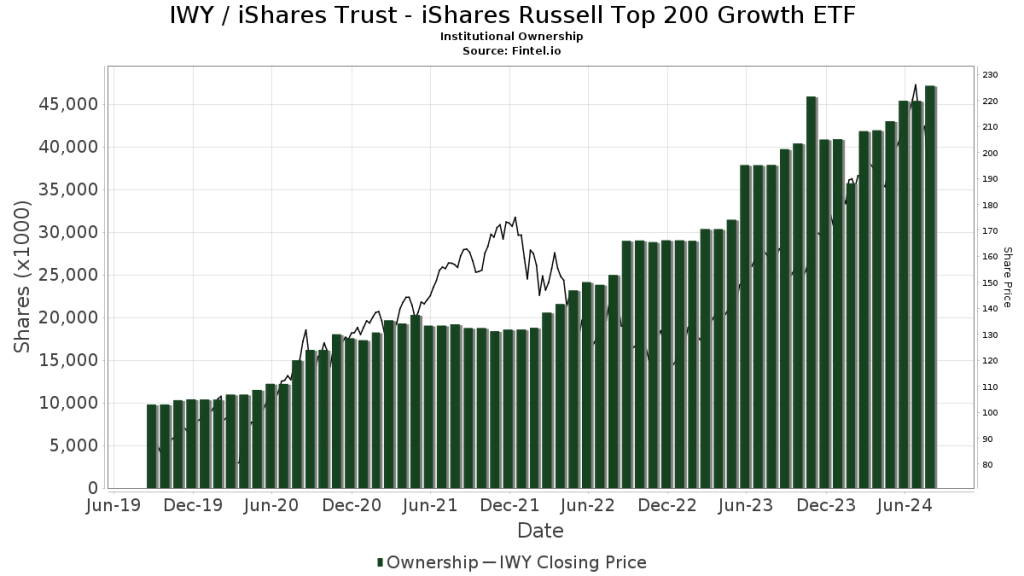

growth ETF – iShares Russell Top 200 Growth ETF (IWY) – $216+ per full share

Whenever you think about the quote “Go big or go home”, a growth ETF should pop in your mind. This type can truly assist you in raising your average salary if you continually invest in it for longevity. To epitomize the specific asset, the iShares Russell Top 200 Growth ETF (IWY) can give you access to maybe 200 of the biggest domestic businesses in United States through their worthy and lucrative stocks that you can buy. According to a source of “iShares” website, the whole stocks are worth $11.351B. This fact alone should inspire you to go above and beyond for your ambitions. If you desire a permanent end to being broke, turn to IWY to the rescue.

real estate investment trust – Vanguard Real Estate ETF (VNQ) – $91+ per full share

Do you want to participate in real estate without dealing with its complications and being required to pay its expenses? Like myself on my Robinhood asset portfolio, you are able to pick a real estate investment trust (REIT) which owns, manages, and sells shares of diverse real estate properties. Investing in a REIT is just as simple as purchasing something else at a store or website. Thus, you can move forward to other things or assets that may entice you. In my frank opinion, you may like the Vanguard Real Estate ETF (VNQ) because of the features below:

- its ownership of over 150 diverse offices, hotels, medical centers, retail stores, etc.

- your opportunity to buy fractional share as low as $1

- If you want to gain a whole share, you have to spend almost $91 extra for it.

- its median market cap of $31.9B

- its return on equity (ROE) which is 7%

- your slight taste of what real estate is like from a perspective of Vanguard broker

VNQ, which represents Prologis Inc. (PLD), American Tower Corp. (AMT), Equinix Inc. (EQIX), Simon Property Group Inc. (SPG), and so on, may mentally take you home away from your physical home. The difference is that you can earn as much real money from that imaginary “place” (VNQ).

“7 Best REIT ETFs for Real Estate Investing (VNQ, SCHH, & More) in 2024” video – “Optimized Portfolio” YouTube channel

index fund – Invesco QQQ Trust ETF (QQQ) – $482+ per full share

Renowned investor, chairman, and CEO of Berkshire Hathaway (Warren Buffett) loves index funds. His first reason is low prices chiefly those of S & P 500 assets. Whether you favor investing in Invesco QQQ Trust ETF (QQQ) or something else, make sure that the index fund carries money from 500+ large or mid-cap American businesses. Secondly, Buffett gives the pleasant fact that any investor who partially or fractionally owns QQQ can receive as much capital as its holding companies (i.e. Apple Inc., Microsoft Corp., NVIDIA Corp., Amazon.com Inc., etc.) do. Regardless of the amount of funds that you pay for QQQ or something similar, you are still a valuable shareholder. But, if you are willing to buy and maintain extra shares of an index fund, you may feel like a lottery winner once you add possible dividends to your bank account(s).

“QQQ Stock 2021 Overview | Invesco QQQ ETF Explained” video – “Joshua Talks Money” YouTube channel

commodity ETF – SPDR Gold Shares ETF (GLD) – $232+ per full share

Commodities are described as natural or raw resources that we humanity need for survival. Water, vegetables, fruits, meats, etc. are productive to our bodies. Even so, we might need a metal commodity (i.e. gold) that can improve our financial situation(s) if natural disaster(s) happens. Gold is typically a tangible property that you can buy, retain, and sell for maximized profit. If you are unable or unwilling to purchase the physical version, you can always turn to SPDR Gold Share ETF (GLD) as your digital and intangible investment. It truly welcomes you into a modern world of ancient gold bullion. Sooner or later, you may become thrilled about the history and evolution of gold in general if you continue buying more shares of GLD. Based on the words of “The Investopedia Team” of “Investopedia” website, you may start appreciating the ETF as a component of your portfolio whenever you become familiar with its details below:

- symbolizing gold for standard of wealth, stability, and protection

- reception of digital access to physical gold through:

- gold company shares

- gold futures

- or gold ETFs

- having a nearly 0.93% annual tracking error anent accommodation(s) of gold bullion (400 ounces of London Gold Delivery bars)

- total of 100,000 shares that are perhaps worth $64.6B

- trading gold and tracking its price for 20 years

- suggestion of numerous investors (including us) to buy and sell shares of GLD only

- Involving physical gold in our transactions can cause us to:

- lose money

- pay expensive fees

- Involving physical gold in our transactions can cause us to:

It is good to shop for the gold ETF for your diversified portfolio. As long as you continuously read and understand data from a credible source (e.g. Investopedia) plus set up an IRA or another retirement account that postpones or exempts increased taxes, you should remain financially hopeful for your future.

cryptocurrency – Bitcoin (BTC) – $61,000+ per full share

If you are passionate about online shopping, you may feel the same concerning cryptocurrency too. Cryptocurrencies provide security, affordability, simplicity, and privacy so that you can pursue a victorious business relationship with other crypto fanatics. The #1 cryptocurrency to recurrently invest is the Bitcoin (BTC). You are capable of getting augmented returns, dividends, or both rewards while you keep advocating advanced technology companies. Plus, you can skip taxes/fees for being a partial owner of a digital or virtual coinage. Your feasible downfall is facing hackers and thieves unexpectedly. Unless you financially educate yourself more information about the pros, cons, etc. of BTC, ethereum (ETH), and other types of cryptocurrency, you should hire financial advisor(s) or crypto expert(s) to aid you in succeeding in the global crypto market.

“Explain BITCOIN to Complete Beginners: Ultimate Guide!!” video – “Coin Bureau” YouTube channel

money market fund – Fidelity Money Market Fund (SPRXX) – $1 per full share

Do you have short-term intentions that you want to achieve instantly? Are you worried about facing an unexpected emergency, vehicular issue, medical crisis, or something else tragic? Then, you probably need to include a money market fund (i.e. Fidelity Money Market Fund (SPRXX)) in your investment portfolio. Of course, putting an adequate amount (e.g. $100) in your savings account every day, week, 2 weeks, or month is incumbent. But, if you are required to spend additional money for an unforeseen disaster concerning you and your loved ones, then you may become desperate, tempted, and susceptible to huge credit card debt. I want to inform that you can steer clear of Satan’s funds by putting as much money as you are able into SPRXX or another money market fund. As a result, you should receive a net expense ratio of 0.42% and a yield of 5.05% – 5.06%. You and your family may therefore be on cloud nine after paying huge expenses and having plenty of money left.

“What is SPRXX? Fidelity Money Market Fund Explained…” video – “The Financial Freedom Show” YouTube channel

Conclusion

Each human being, including you and me, is a consumer or customer. We all need to go to entrepreneurs for both of our needs or cravings – food, water, clothing, shelter, jobs, etc. However, the ultimate stumbling block is that most of us consumers/customers choose to waste or spend money on junk food/beverages and materialistic items that leave us broke. Only a small number of us becomes investors in order to generate our salaries and spend portions of those amounts on our needs/desires. This is how the economic system works sadly.

“Why The STOCK MARKET Is So Important In Our Economic System & How To Use It” video – “Minority Mindset Clips” YouTube channel

I wish that I have become financially self-taught in my early 20’s as 23 year old YouTuber and investor Marcos Milla does. But, I have kept myself in the dark about investments, entrepreneurship, etc. instead. I have chosen to believe that my parents, former instructors, and other role models are going to tell, encourage, and furnish me everything that I need for success and survival. I now realize that only the Lord Jesus Christ can make that occur.

Thanks to Him and this blog of 7 years, I am wiser, more knowledgeable, and more competent with my skills in reading, writing, grammar, business, finances, and so forth.

I am not blind to a secular, greedy, manipulative, and biased system anymore.

While it continues to keep many individuals broke, despondent, and dependent on others, I can thoroughly wake up my eyes to the possibility of:

- earning a large wage through different assets

- taking FCW business with my Ukrainian friend (Elizabeth) to the next level

- finding an angelic lady who fulfills or exceeds my expectations

I forever show my gratitude to our extraordinary and sovereign God.

Please consider buying fractional or whole shares of the 10 investments that I have identified.

You can also find other comparable assets that you prefer to obtain instead of the ones that I have already explained on the top.

When you go on a brokerage website (i.e. Robinhood, Fidelity, Interactive Brokers, or Vanguard), just pay attention to certain categories such as growth ETF, mid-cap stock, index fund, cryptocurrency, and/or so on.

The more fiscal details that you learn and teach yourself is going to direct you to more financial literacy and success.

You can undoubtedly reach the level of people who have mastered their skills in the stock market.

Put in the hard work.

It would pay off once your financial returns, dividends, and/or dreams approach you with open arms.

If you truly like this blog post, please like, subscribe, share with others, and comment below.

I would appreciate it.

Furthermore, let me know which specific investments and how many shares (whether they are fractional, whole, or both) that you want to buy and own in your portfolio(s).

I would inevitably know that I have made a positive difference in your financial life.

[…] 09/05/2024 UPDATE: Are you (American or Westernized man) unsure, undecided, and/or overwhelmed about the stock market? If so, based on my recent experience, I strongly recommend that you create watchlists on online brokers such as Robinhood, Betterment, Vanguard, Charles Schwab, Interactive Brokers, CashApp, etc.? Please create watchlists based on these categories or classes of investments: […]

LikeLike

[…] maintain learning, staying optimistic, praying to the Lord Jesus Christ, and buying assets that are going to impact everything in your […]

LikeLike