Based on this blog post title, I like to discuss what you (American or Western man) and I spend our money frequently. While the rich becomes richer, the poor becomes poorer. Why is this good and bad news for different human beings happening simultaneously? My only reason that I can ponder is their management of funds. How they, you, and I save, spend, and perhaps invest our money determines the long-term amounts that we earn consequentially.

Teaching myself about finances, online entrepreneurship, and the stock market has truly become the best “financial medicine” for my current situation. You are not going to get the same effect(s) from licensed or certified instructors. Unless you have an extraordinary friend or relative who is willing to teach you how to become fiscally successful and free for the remainder of your life, the decision is up to you to do the education for yourself and your legacy. Like myself, you can put an end to your negative monetary cycle of being broke, either working at a low-income job or being unemployed, and/or having a failed business of your own by thoroughly learning, understanding, and taking advantage of our economic system.

Thus, buy or get a nice notebook, ink pens (black, red, and blue), and 1 – 2 yellow highlighters so that you can begin writing down a long list of complicated financial words from various sources.

In addition, do the same activity on this blog post as well.

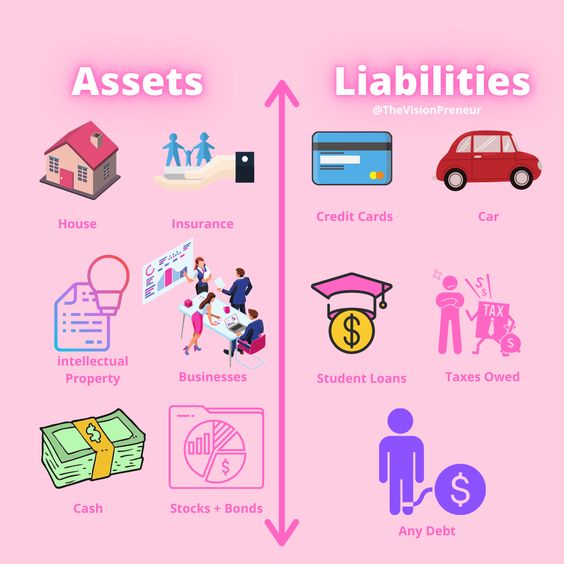

I am going to compare and contrast 2 things that we buy whether we are fully aware of them or not.

Please read the information below and take notes:

Description: 2 easy ways of comprehending this financial term are:

- bills or money that you owe

- earnings or money that you are owed for labor or work

Of course, countless humans, including myself and perhaps you, do not like spending money for health insurance, auto insurance, mortgage, groceries, gas, etc. that we need frequently. However, we like how much we are going to receive on our weekly or biweekly paychecks or direct deposits. Depending on who, where, and what sort of work that we perform, we earn certain amounts fairly or unfairly. Liabilities also describe products or services that we need or want to purchase. The main problem is that they may leave us with broke with little to no money.

Examples: health insurance; auto insurance; auto loans; mortgage; food; groceries; vehicles; houses; electronics; jewelry; beverages; video games; student loans; credit card debts; medical debts; other products; other services; “Buy Now, Pay Later” (BNPL) payment methods such as PayPal Credit, Klarna, Affirm, etc.

Pros:

- borrowing money, loan, or valuable asset(s) temporarily

- ability to purchase a good, product, or service through a BNPL payment option

- chance to grow your dream business over time

- motivation to become more responsible in paying separate fees in full amount and on time

- ease of paying minimum amounts every month

Cons:

- facing regular fees that include unpleasant or expensive interest fees

- potential loss of your dream business, home, vehicle(s), and/or other belongings if you are unable or refuse to pay required debts in full time, on time, or both

- possible time in prison if you borrow money and cannot/refuse to pay it back to whoever (e.g. governmental organization or administrative company) has given you the loan

“Assets VS Liabilities: What Do YOU Have?” video – “Minority Mindset Clips” YouTube channel

Description: To help you understand this second financial keyword, I suggest that you observe your possessions. Which ones are simple for you to market and sell for desirable costs? Do you mostly have the remaining stuff that no one wants or needs to buy? If you are so charismatic, skilled, goal-oriented, etc. that you can attract hundreds, thousands, or even millions of buyers to your feasible business(es), then you should actually be proud of yourself. But, if you have always struggled to increase your income like I do for most of my life, then you should analyze and concentrate on these real investments (which are also called assets):

- individual company stocks

- The “Magnificent 7” stocks are great examples:

- Consider Verizon, Palantir Technologies, Home Depot, Wells Fargo, and Chipotle stocks as worthy assets too.

- exchange-traded funds (ETFs)

- Here is a list of popular ones from online brokers:

- Vanguard

- VOO, VYM, VIG, VUG, VTI, VGSH, BND, VONG, VXUS, VWO, VOE, VOT, VT, VB, and VFH

- Charles Schwab

- SCHD, SCHG, SCHW, SCHX, SCHH, and SCHB

- iShares (BlackRock)

- IWM, TLT, IVV, and AGG

- Fidelity

- FBND, FDVV, and FMAG

- Dow Jones

- DIA, IYR, IYY, and DVY

- Vanguard

- Here is a list of popular ones from online brokers:

- index funds

- Investigate and decide if you wish to buy fractional/whole shares from these particular ones:

- Vanguard

- VFIAX, VBIAX, VTSAX, so on

- Charles Schwab

- SWPPX, SWTSX, SWISX, SWAGX, so on

- Fidelity

- FXAIX, FSMDX, FSSNX, FSGGX, FXNAX, FBIIX, and FFNOX

- Do Google research on Fidelity ZERO index funds if you are interested in more details as well.

- Vanguard

- Investigate and decide if you wish to buy fractional/whole shares from these particular ones:

- bonds

- Find certain ones that belong to Vanguard, Fidelity, Charles Schwab, BlackRock, State Street, etc.

- Bonds can protect your money in the stock market during inflation, crashes, and/or other issues that occur.

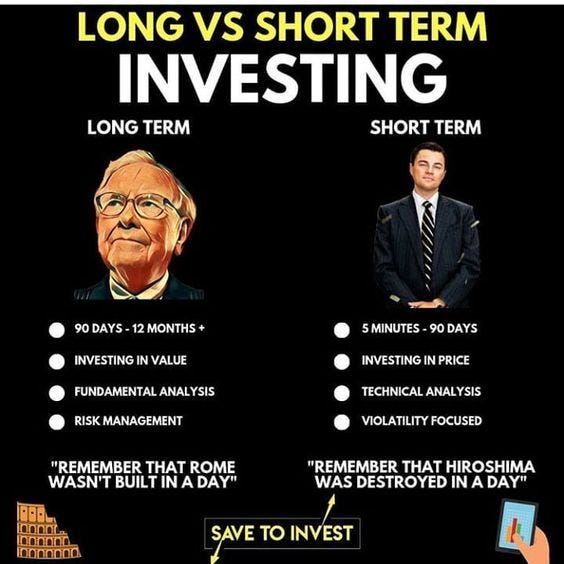

- Legendary investor, CEO, and chairman (Warren Buffett) of Berkshire Hathaway advises everyone to pick short-term government bonds for each quarter (season) of a year.

- real estate

- If you crave to invest in physical land, residential homes, and/or commercial and industrial properties, please visit these websites for your financial goal(s):

- Dig up additional data and consult real estate professionals for more support.

- If you wish to avoid dealing with complications, expenses, and unreasonable tenants and others behind the real estate industry, then buy real estate investment trusts (REITs) instead.

- cryptocurrencies

- As a matter of fact, Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and Tether (USDT) are 5 of the 10 best cryptocurrencies in this world.

- money market funds

- commodities

- Search and pursue gold ETFs and other commodity funds for protection from inflation, etc.

- other investments

- Retain searching and taking notes if you sooner or later wish to invest in the ones that I do not mention.

You may become astounded of how much capital and financial freedom that you gain if you recurrently buy and own shares of stocks, ETFs, and/or other assets. Time is also another factor that determines your net worth too. You can live like a king with both a surplus of money and ample time on your side.

Examples: vehicles; houses; electronics; jewelry; equipment; machinery; tools; stocks; bonds; exchange-traded funds (ETFs); mutual funds; index funds; high yield savings accounts (HYSAs); cash; collectibles; real estate properties; skills; personnel; inventory; money market funds; commodities

Pros:

- owning and controlling something valuable and desirable to others

- feeling optimistic of achieving your fiscal goals

- capacity of growing your wealth, business, legacy, etc.

- helping and encouraging your family members and friends to also do long-term investing

- appreciating how the economic system and stock market operate

- assisting others in need financially

- ease of arranging your ideal home, business, etc.

- getting dividend profits in return for keeping shares

Cons:

- acquiring patience to increase your income from investment portfolio(s)

- requirement of buying more fractional or entire shares of stocks, ETFs, and other assets in order to build your wealth

- temptation of trading a stock or selling investments if you are scared of a stock market crash or loss of your money

- facing unlikable or hidden taxes and fees if you choose to sell your shares

“4 Assets That Make You Rich | Robert Kiyosaki” video – “Success Resources Australia” YouTube channel

Conclusion

Hopefully, you are now utterly aware of the differences between liabilities and assets. Liabilities are loans, debts, or bills that you are legally required or forced to pay. If you want to earn more money, you must buy assets (investments) again and again.

Thanks to the growth of inflation, unemployment, AI (artificial intelligence), etc., saving money is not good enough anymore. You can still result in being as broke as someone who spends all of his or her money on liabilities do. Nevertheless, if you willingly join an online group or community of long-term investors, you can obtain an excessive amount of money to cover all of your expenses.

Based on my 3 months of experience, investing in the stock market is extra fun than it seems. But, I recommend that you study the terminology of finances often. Create a fiscal dictionary on your physical notebook and/or through your Microsoft Word document file for collecting and defining each complex word that you record from a book, article, video, and so forth. As you mentally grasp the meanings like I do, you can select the stocks, ETFs, and/or other assets that are suitable for you to purchase.

I recommend CashApp as a remarkable brokerage app for purchasing and collecting popular individual stocks including the “Magnificent Seven”. The mobile app also has sufficient Vanguard ETFs which are great if you desire to steer clear from financial risks of investing in stocks only. But, in my candid opinion, I advise you to buy more ETFs on Robinhood, Vanguard, Fidelity, moomoo, etc. apps/websites. Receiving dividends and/or compound interest from the ETFs in your portfolio(s) may give you a more positive outlook on the online brokers.

Change your life and those of your loved ones for the better.

Get involved in the stock market, real estate industry, your own business (if you have one), and so forth.

Extra jobs are scarce to this day due to greed, discrimination, stinginess, and dependence on AI.

Therefore, supplementary people may have to create their own jobs/companies and hustle for getting enough money for their daily, weekly, and monthly needs.

We are truly living in a sad and messed up world.

Anyways, maintain learning, staying optimistic, praying to the Lord Jesus Christ, and buying assets that are going to impact everything in your life.

[…] is going to give you the energy that you need for achieving your personal, professional, and even financial […]

LikeLike

[…] planets; people; animals; plants; trees; other natural or God-made things; artificial things including buildings, foods, and beverages; money; other artificial or man-made […]

LikeLike

[…] that I can collect more shares. This investment duty is just as fun as purchasing and accumulating liabilities or materialistic items (that may depreciate or become worthless someday) are. You can become an […]

LikeLike