To answer the above WordPress daily writing prompt, I have developed an acronym that depicts 5 brokerage websites or mobile apps – BRAVE. Each letter from the acronym is an initial…meaning that it starts a name of an investment company. In addition, I have picked the acronym due to my courage and interest in becoming a member of 4 of the 5 online brokers that I am going to mention below.

Do your friends, relatives, and other locals consider you (American or Westernized man) fearless?

Do you have the bravery and desire to set up brokerage account(s) and increase your wealth for long-term retirement?

Take a look of the 5 easiest and most user-friendly investment websites/apps that can guide you on your journey to financial literacy, success, and freedom:

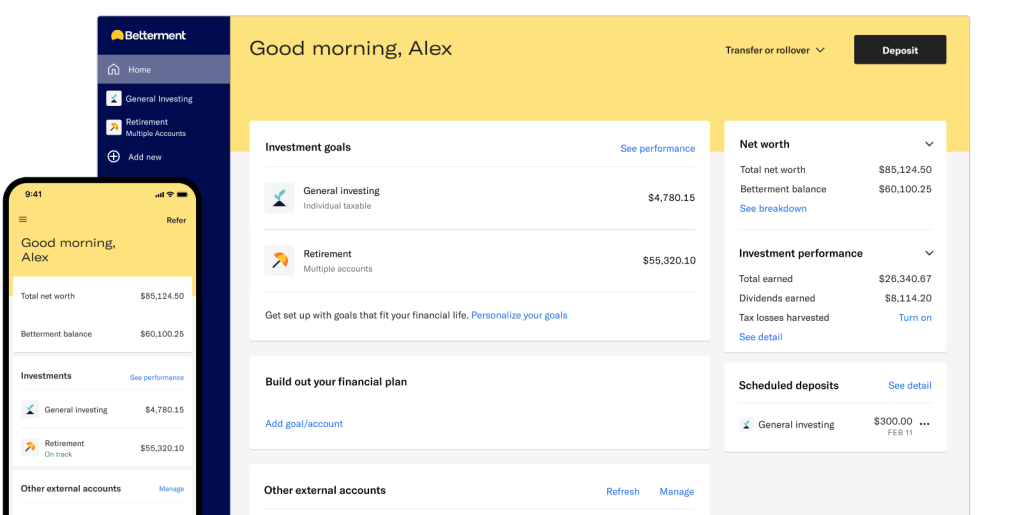

Description: If you are inexperienced or new to investing, you should give Betterment website or app a try. Human advisors, robo-advisors, or both types of financial experts have designed and simplified the process of registering, creating separate accounts (i.e. general investing, crypto investing, IRA, cash reserve (4.50% APY), bond investing (5.72% APY), and checking), and choosing which assets is suitable for you. You also have a right to select the investments that interest you too. After you are finished, you can move forward to other tasks that you want or need to do. Later, you can perform any or all 3 of these things as a new member:

- manually transferring your money from your bank account or paycheck to any Betterment brokerage account that you create

- setting up an automatic investment plan (AIP) in order to have a certain amount(s) deposited into your brokerage account(s) per day, week, 2 weeks, or month

- customizing and picking a name, target amount, target date, etc. from each financial goal (i.e. a planned vacation, spectacular wedding, overwhelming student loan debt, or stressful vehicular fees) that you have

Purpose: In 2008, Harvard University and Columbia Business School graduate (Jon Stein) has established Betterment firm in hopes of helping numerous humans with little or no investing experience. Ergo, they can envision the light, positive, quick, and easy sides of the stock market, finances, and so on. For 16 years, he and his elite team have assisted more than 900,000 paying members accomplish both of their short-term and long-term aims by analyzing, strategizing, organizing, and putting their fiscal dreams into action. Now that AI (artificial intelligence) is existent and evolving, everyone can worry less plus work smarter while enjoying the remainder of his or her life. Current CEO (Sarah Levy) is constantly making sure of that reality by promoting amusement, unity, consistency, etc. at her workforce(s), online, and the rest of the world.

Benefits:

- ease of creating different accounts

- seeing the total amount that you have from all of your accounts once you login or return to the main webpage

- selecting the portfolio (e.g. Core, Broad Impact, or Goldman Sachs Smart Beta), risk level (i.e. 50% stocks and 50% bonds), and initial deposit amount (e.g. $5,000) that suit your financial needs or desires

- chance to modify your specific goals individually

- unlimited support from both robo-advisors and human advisors

Disadvantages:

- getting unwanted fees that depend on how much money that you have in your account(s), what you do with your investment portfolio(s), and/or even if you transfer all of your money to your bank account or another brokerage account

- minimum requirement of $10 or more money for depositing in an investing account or financial goal

- minimum requirement of $50 or extra money to deposit in a crypto investing account

- unavailable customer service on Saturdays and Sundays

- no ability to buy, trade, or sell individual company stocks

Robinhood – Click this referral link if you want to sign up for a free Robinhood account so that we both can get free shares of company stocks.

Description: Do you yearn a prospect to invest in stocks, exchange-traded funds (ETFs), cryptocurrencies, and options for $1 each? Robinhood website or app allows you to take such action by buying fractional shares. Whether you are an amateur or professional, you can still purchase your ideal investments for your chosen prices. You can deposit more money into your single Robinhood account or an asset so that you can keep investing. Furthermore, you may fall in love with ticker symbols and earned interest for uninvested cash in your account balance as I have. Tickers, also known as ticker symbols or stock symbols, are simple and fun to learn because they help you become (more) creative and knowledgeable about the stock and crypto markets. Another pleasant surprise is actually getting extra funds in your account if you keep them from a deposit or sale of shares. If you wish to win additional prizes, then upgrade your account to Robinhood Gold for a monthly fee of $5 or an annual fee of $50. The higher interest rate on your uninvested cash balance, a reception of a physical credit card, and the odds of getting your money back from previous transactions may put a big smile on your face.

Purpose: To promote freedom, democracy, and simplicity, 2 diverse developers (Vladimir Tenev and Baiju Bhatt) have collaborated on a huge brokerage website/app project named Robinhood in order to change their financial lives forever and dramatically. Their initial purpose is to expose middle-class individuals to the stock and crypto markets. Charging such members $0 or nothing at all for their participation is a great motive. Next, Tenev and Bhatt crave to give them an opportunity to invest tremendously and thus gain as much capital or compound growth as rich people do. Current Robinhood members including myself can relax and realize that we can go after our wishes/needs in a matter of time.

Benefits:

- ease of investing in stocks, ETFs, bonds, options, and cryptocurrencies

- selecting fractional shares for as low as $1 each

- opening a single Robinhood account free of charge

- obtaining legal protection of your personal and financial information plus assets through Financial Industry Regulatory Authority (Finra) and the Securities and Exchange Commission (SEC)

- getting interest for retaining uninvested cash in your Robinhood account

- ability to use your debit card (which you have to pay a short fee) for depositing funds or buying investments

Disadvantages:

- not having access to further in-depth market data

- unavailability of mutual funds and bonds

- no way of getting in full contact of customer support personnel

- facing possible technical difficulties on the website or app

“Robinhood Investing For Beginners | ULTIMATE Tutorial (2024)” video – “Ryan Scribner” YouTube channel

Acorns – Here is another referral link if you want a subscription plan for $3, $6, or $12 per month. You can receive a $5 bonus share on a ETF.

Description: A squirrel, its nut(s), and a growth of wealth should come to your mind whenever you think about “Acorns” website or mobile app. Although you have to pay $3 per month for the “Personal” membership, you are encouraged to invest a small amount (i.e. $5) recurrently. There is the “Round-Up Investment” system that tracks your earlier transactions once you share your login credentials on the brokerage website or app. The particular system gives you “spare change” if you pick the transactions that are recently recorded from your linked checking or savings account. In other words, the system automatically subtracts money from your bank or credit union account and splits it for each asset within your investment portfolio (which composes of 3 stock ETFs and 2 bond ETFs. Later, if you wish to access to extra features, you are required to upgrade your subscription to any of these 2 higher memberships:

- Personal Plus ($6 monthly)

- As a consequence, you are going to receive:

- “Acorns Later” retirement

- 1% IRA match on new contributions

- extra bonus investments on rewards

- live Q & A with financial experts

- As a consequence, you are going to receive:

- Premium ($12 monthly)

- Your auxiliary advantages are:

- 3% IRA on new contributions

- setting up investment account(s) for your feasible child or children

- choice of stocks, bonds, etc. that you want to invest in your portfolio

- reception of an upgraded tungsten metal debit card

- so on

- Your auxiliary advantages are:

Despite that the monthly subscription fees are somewhat displeasing, you may be eventually happier. Also, you may recognize the fact that you can earn so much money (at an older or retirement age) thanks to possible reinvestments of your dividends and repetition of small deposits into your portfolio. For reassurance:

- watch helpful tutorial videos on the website or app

- subscribe to the “Acorns” YouTube channel which as 30.7 subscribers, major endorsement from Dwayne “The Rock” Johnson, and 80 videos

- see graph charts of current Acorns members concerning their potential future balances

- contact Acorns Support via phone (855-739-2859), text chatting, Help Center, and/or email communication

Grow your “oak tree” with Acorns today.

Purpose: It is the tenth anniversary of Acorns company that has its exceptional website and mobile app. Father (Walter Wemple Cruttenden III) and son (Jeffrey James Cruttenden) team have combined their ideas, money, etc. in order to attract inexperienced members who wish to achieve their long-term fiscal goals. In some way, the co-founders have designed Acorns website/app as family-friendly because both parents and children can learn and teach other how to save, spend, and invest prudently. So, if you desire to have fun in studying finances and the stock market with your loved ones, please consider this intuitive brokerage website/app. Subscribe and watch its YouTube videos in order to be (more) encouraged to start your passive investing journey as soon as possible.

- simplicity of investing in the stock market

- manually recurrently depositing currency which is automatically distributed or divided into 3 stock ETFs and 2 bond ETFs

- choice to pick a monthly subscription plan based on its certain features or advantages

- getting an one and only asset portfolio that is personalized, various, automated, and partial to the ESG (Environmental, Social, and Governance) model

- chance to obtain a checking account plus the Acorns Mighty Oak debit card depending on the subscription plan that you currently have

Disadvantages:

- requirement to pay $3, $6, or $12 per month

- no investing in cryptocurrency (e.g. Bitcoin (BTC))

- Acorns company graded as a failure by Better Business Bureau due to its problems with licensing, government, bankruptcy, advertising, etc.

- limited or certain abilities that are only available with the $6 or $12 monthly membership

“Acorns Review: My Honest Thoughts…” video – “Humphrey Yang” YouTube channel

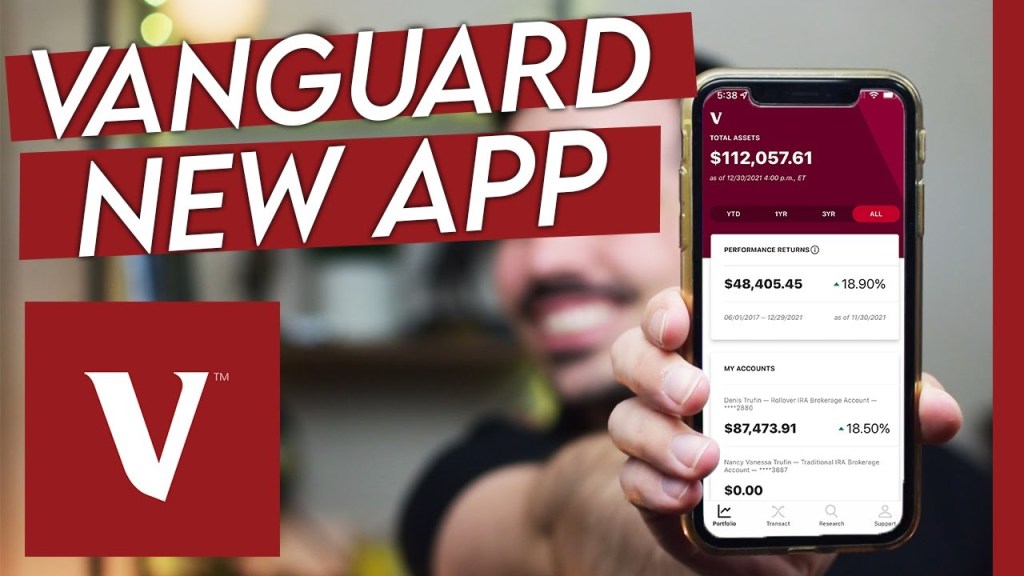

Description: If you crave the best of the best in the stock market, ponder setting up a Vanguard brokerage account as your primary or only source of portfolio income. You are able to get exclusive access to these particular funds:

- money market funds

- VGHV funds (private equity)

- closed funds (through Vanguard’s Personal Advisor Wealth Management)

- Advice Select funds (provided by Vanguard’s Personal Advisor investment decision)

Pay any of them as well as other assets, which you can search on Robinhood, Fidelity, moomoo, and other online brokers, for a minimum of a dollar. According to the “Why Choose Vanguard” webpage, the almost 50 year old global investment corporation (Vanguard) has expected to entice different investors (including me and you perhaps) despite of our net worth or earnings. Hence, we are capable of obtaining more confidence and improving our leadership skills. If we become registered members and investors on Vanguard website or mobile app, then we are officially recognized as owners of the business. For additional assistance in accomplishing financial triumph, please read the 4 principles (goals, balance, costs, and discipline) while taking notes and studying them persistently.

Purpose: What has triggered the existence of Vanguard corporation is the 1929 Wellington Fund (VWELX). Author Andriy Blokhin of “Investopedia” website has confirmed that VWELX is the first American mutual fund to rise above $112 billion through large-cap stocks, bonds, etc. Another remarkable advantage of VWELX is its survival or overcoming the 1929 – 1939 Great Depression plus other unexpected and unfortunate economic collapses (e.g. the 2007 Great Recession, 2020 COVID-19 pandemic, and now the 2024 inflation, unemployment, and debt crises). Humane and humble, Vanguard founder (John C. Bogle) has destined VWELX as a financial tool, role model, aide, and way for millions of investors to increase their wealth incessantly. Thanks to his nonstop diligence and coherent and specified vision of how Vanguard company should be constructed, extra popular funds have emanated such as:

- 1975 Vanguard Cash Reserves Federal Money Market Fund (VMRXX)

- It has been called Vanguard Prime Money Market Fund since the beginning.

- 1976 Vanguard 500 Index Fund (VFIAX)

- It has been previously known as the First Index Investment Trust.

- 1977 municipal bond funds

- They are composed of:

- short-term maturities

- intermediate-term maturities

- long-term maturities

- They are composed of:

- 1981 Vanguard Federal Money Market Fund (VMFXX)

- and the list goes on chronologically

If you desiderate more details of the consecutive history of Vanguard corporation, please click this text link:

Benefits:

- access to exclusive investments including:

- mutual funds

- certificates of deposits (CDs)

- money market funds

- likelihood to purchase and own fractional shares of various asset products for $1 each

- getting treated as a fair human beings and reputable investor

- achievement of both of your short-term and long-term monetary goals

- extension of your capital

- through purchased and kept shares of assets

- expansion of your financial literacy

- by reading and taking notes of subsequent webpages of Vanguard website(s)

Disadvantages:

- no access or availability of bitcoin (BTC), ethereum (ETH), and other cryptocurrencies at all

- possible delay of registering and creating a Vanguard account

- failing grade of Vanguard corporation due to Better Business Bureau receiving negative reports or complaints continuously

- difficult requirements to follow concerning investing in certain funds

Description: Like Vanguard, E*TRADE provides its members a chance to invest in mutual funds, CDs, and bonds. The difference is that E*TRADE only has futures trading. What is the rationale for that? Here are a few reasons:

- Multiple investors are willing and fiscally capable of buying and selling assets to each other equally.

- There are little to no management, brokerage commissions, and/or other trading fees per annum.

- 24 hour access to the futures market and its details

If you wish to scrutinize more facts about futures trading, options trading, etc. on E*TRADE, please read and take notes of the following linked review webpage:

Purpose: The original name of E*TRADE is TradePlus. In 1982, establishers William A. Porter and Bernard A. Newcomb have invested and put together $15,000 for this partnership business. A year later, they have commenced its physical trading services. They have waited 9 more years to make or finish the electronic version of buying and selling stocks, bonds, and other assets through computers with Internet connectivity. Summer 1996 has caused them to publicize their corporation through an initial public offering (IPO). Another well-known corporation (Morgan Stanley) is thus willing and able to purchase and combine with theirs 24 years after that event. E*TRADE is currently and hugely successful despite that its founders have passed away.

Benefits:

- E*TRADE corporation officially known as the first broker to start online trading services

- receiving online assistance from consultants who can help you invest in options, futures, and other fiscal instruments

- availability of financial education through tutorial videos, steps, levels, etc.

- acquiring asset portfolio(s) that is planned for storing mutual funds, ETFs, or both

- capacity to set up an E*TRADE brokerage account and trade stocks, bonds, ETFs, etc. for free

- only potential to reinvest dividend profits for fractional shares of stocks, bonds, etc.

- feasibly facing required and expensive margin fees

- no prospect of trading foreign currencies or cryptocurrencies

- However, you can invest in Bitcoin futures or Bitcoin ETFs though.

- disappointment or frustration of E*TRADE mobile app

- getting short interest rate for holding uninvested cash

“Check out what etrade.com has to offer” video – “E*TRADE from Morgan Stanley” YouTube channel

Conclusion

Hopefully, after reading the description, purpose, pros, and cons of each of the 5 digital brokers, you now have the “BRAVE-ry” to join any of them for your monetary goals. Financial literacy is so significant nowadays due to the rise of expensive prices (inflation), unemployment, and other economic difficulties. If you, I, and others become more open to fiscal education, we can utterly understand how money works and which mental tools we need for taking advantage of the economic system.

I enjoy researching and summarizing every brokerage website or app for this blog post. Obviously, there are other phenomenal brokers such as:

- Charles Schwab

- Fidelity Investments

- Moomoo

- If you accept my invitation and register for a Moomoo account, you can get:

- 15 free shares of company stocks

- 8.1 annual percentage yield (APY)

- If you accept my invitation and register for a Moomoo account, you can get:

- Webull

- Interactive Brokers

- CashApp

- Wealthfront

- Stash

- Edward Jones Investments

If you are interested in them, do your own examination. Google AI is a great beginning. No matter what your questions or concerns are, you are able to candidly get awesome responses from it.

Do you appreciate what I have spoken regarding the 5 online brokers that comprise the acronym ‘BRAVE‘?

If your answer is ‘yes’, then please like, comment, share, and subscribe to this one-of-a-kind blog of 7 years.

Someday, I hope that I can monetize it and earn plenty of funds for more investments.

Click on any of the referral links that I have provided above if you want to register for brokerage account(s) and buy fractional shares of stocks, bonds, ETFs, etc.

I want you to repeat the same action for your own legacy, family, and potential wife/girlfriend with possible children.